#1 Rated Tax Firm Since 2017

Get up to $26,000 per Employee

- Get your Tax Refund Checks from the IRS for ERC

- Zero money upfront and Free Analysis

- Qualify for all 6 quarters in just minutes

- 90% of businesses qualify - don't miss out

- You don't have to pay this back - It's not a loan

Your ERC is Insured By Audit Protection

Professional Liability Errors & Omissions Insurance

Beware of who you trust to get your ERC refund.

Checkout the IRS's News Release with guidelines on who to trust.

We Have You Covered

BILLIONS in ERC Claimed for Businesses Like Yours

Testimonials

Real People, Real Money, Real Results

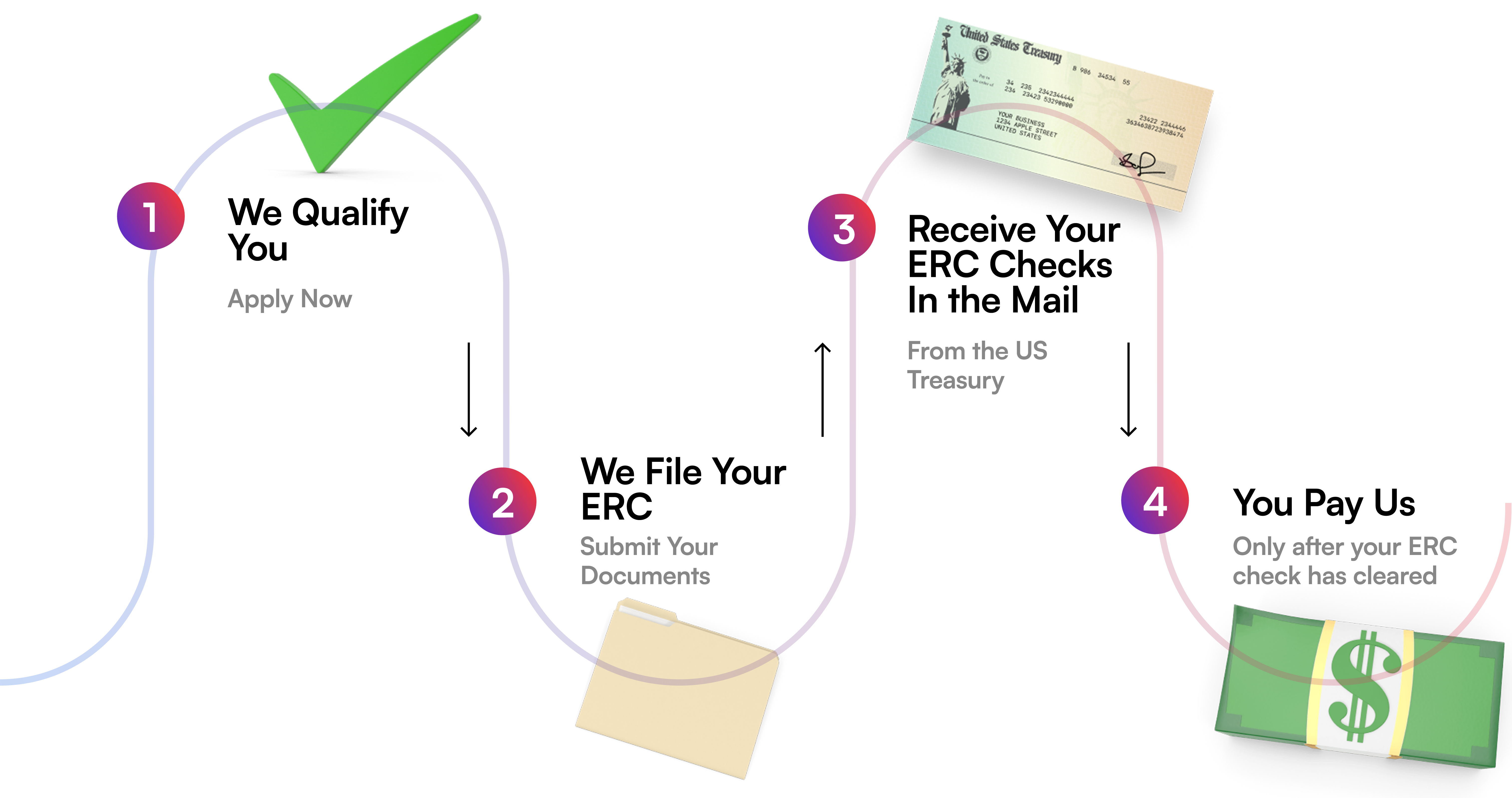

We Make It Easy

Our Simple 4-Step Process

Our 3-Tier QA Process

- Accuracy

- Maximized ERC Amount

- Successfully Approved

Find Out Why Professional Liability & E&O Insurance is Important

Professional Liability Errors & Omissions Insurance

Your ERC Claim Starts Here

OUR Average ERC amount we secure is $400,000. How much is waiting for your business? Get qualified in minutes NOW.

Confirm Your Qualification in 4 Minutes

Start Your Process – Speak to A Specialist

File with Assurance

Our tax and government order specialists ensure the accuracy of your ERC

- No upfront fees

- We stand by our work & help in case of audit

- ERC work is backed by insurance - Audit Protection

- 256-bit encryption to secure your information

- Successfully Approved

Live Support You Can Trust

Our clients have real people responding to them when needed. We are fast, efficient, and highly responsive.

- The ERC Specialist assigned to you ensures accurate qualification, calculations, and quick filing

It's Your Capital, Waiting for You

There’s currently $400 billion approved for ERC. How much ERC money is ready to be given to your business?

What Makes Us Different

- We Protect You

Our work is insured by Berkshire Hathaway

- Get More ERC Money

We know how you qualify for all 6 quarters

- Get Your Full Documents

We give you a full 150+ page detailed report of all your government orders & calculations

- 2,000+ 5-Star Google Reviews

Others have very little to no reviews

What is Employee Retention Credit?

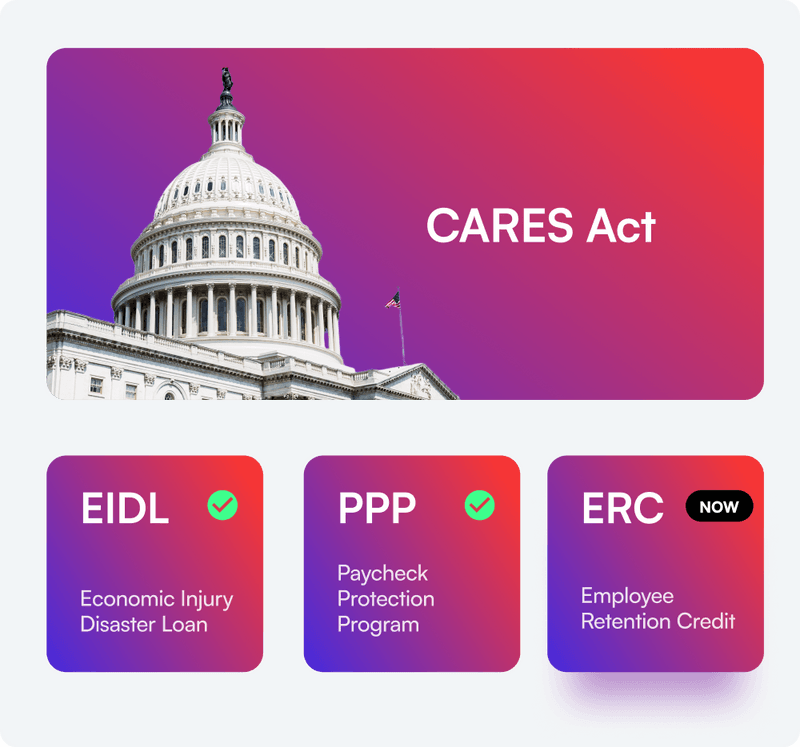

Created by the CARES Act, the Employee Retention Credit (ERC) is an economic stimulus program that rewards eligible employers, which are 80%+ of all businesses (essential and non-essential) for retaining employees on their payroll W2s. If your business implemented safety measures, or experienced COVID-related disruptions, or government-imposed restrictions throughout the pandemic in 2020 and 2021, you are eligible for this program.

Retention Program Amendments

It was amended various times to ensure that big and small businesses get the compensation they deserve. Here are the amendments that took place:

The Taxpayer Certainty along with the disaster Tax Relief Act of 2020 (Relief Act) revised and extended this economic stimulus for the first and second calendar quarters of 2021.

The American Rescue Plan Act of 2021 (ARP Act) altered and extended this tax retention credit for the third and fourth quarters of 2021.

The Infrastructure Investment and Jobs Act (Infrastructure Act), terminated ERTC for wages received in the fourth quarter of 2021 for employers that are not recovery startup businesses.

We know how you qualify. We guarantee it!

Under the consolidated appropriations act, ERTC was amended in 2021 to provide up to $5,000 per employee for 2020, and up to $7,000 per employee for each of the first three quarters of 2021.

A large or small Business can receive up to $26,000 per employee and 80%+ of all companies can qualify for this tax credit program.

This incentive pays a greater incentive for eligible employers than Pay Check Protection Program because you are not required to use it for business expenses. It is not a loan, it is yours to keep.

We Guarantee Making This Quick & Easy

Call us to help you download your payroll files and complete your intake form all in less than 6 minutes while on the phone with us. Seriously, that’s it.

How to Qualify

Cleaning / Sanitization

Capacity Restrictions

Supply Chain Disruptions

Travel Restrictions

Commerce Disruptions

Group Gathering Limitations

Vendor / Customer Restrictions

Full or Partial Shutdowns

Jobsite / Customer Shutdowns

Work from Home Orders

Who is Sunrise Business Solutions?

At our core, our philosophy is simple: every client is important to us. We are dedicated to providing personalized solutions that meet the unique needs of each client, and we believe that when our clients succeed, we succeed.

Since 2017, clients have chosen us for our insightful guidance in helping them forge pathways to success, whatever challenges they’re facing.

Since 2017, we have been dedicated to helping businesses achieve growth and success. Our specialty financial and accounting tax firm is led by a team of passionate professionals who are committed to improving performance, results, and goals for our clients. As the nation’s #1 rated ERC tax accounting firm, we are dedicated to helping companies benefit from government incentive programs that are available to them.

We work with a wide range of clients, including entrepreneurial start-ups, SMBs, investment banks, and some of the most affluent and high net worth individuals. However, we are much more than just a tax firm. We care about the success of our clients and strive to provide compassionate and honest service in everything we do.

We offer a complete spectrum of financial, tax and accounting, assurance and advisory services. Our industry-focused practices offer deep insight and specialized services to privately held and publicly registered companies, and nonprofit and social sector organizations. The Firm also provides a full complement of marketing, technology, wealth management, and virtual accounting staffing services.

SUNRISE is one of the largest independent specialty Financial & Accounting Tax Firm in the nation, with offices in major business markets throughout the nation

We're Committed to Success with Integrity

Our success is based on accountable, honest, trustworthy, ethical, and compliant results. Let us handle the hard stuff so you can focus on what you do best. With experience from thousands of clients, we’ll apply our knowledge to ensure your compliance and qualification for ERC. Our specialized team prioritizes risk management, compliance, and finance, and we understand and adapt to rule changes. We’re proud members of top professional Accounting and Legal affiliations, driven by our compassion for compliance.

Our mission is to Help Every Qualified Business in the United States Receive the ERC Incentive

The more we care about your success, the more success we have too.

We Have Grit & Wit

100+

US in numbers

28k

Hours per month

1,162

Cups of coffee a week

Social Impact

Delivering ERC with Global Impact

Our Commitment to the Future

Giving Back to the Planet & the People

We are planting a tree and providing a meal for every ERC employee our clients have.

Find Out Why Professional Liability & E&O Insurance is Important

Professional Liability Errors & Omissions Insurance

Frequently Asked Questions

There are no up-front fees. Our fee is a percentage of your refund and lower if you are a non-profit. You will never come out of pocket to pay our fee. You pay us only after you have received the ERC checks.

Our fee includes preparation of your claims by professionals who are experienced in qualifying, calculating, and filing your ERC claim. (We have Berkshire Hathaway’s Professional Liability and Errors & Omissions Insurance: We Stand by Our Work).

No Upfront Fees – We Invoice you After You have Received Your ERC Checks

We Stand By Our Work.

100% Guaranteed and Our Work is backed by Berkshire Hathaway Insurance Professional Liability Errors & Omissions Insurance.

150 Page report of your Qualifications, Calculations, Application, & Major Government Orders

We Ensure you remain compliant with IRS Circular 230 and in your calculations by preventing double-dipping with other CARES ACT programs.

Absolutely! A decline in revenue is not required. It is only one of the ways to qualify. Majority of our clients had increase in revenue, but were still negatively impacted by covid restrictions, vendor disruptions, and supply chain issues.

YES, PPP Borrowers can Now get ERC.

ERC is a better incentive than PPP. Typically, 2-5x More Money.

Your business can now have PPP1 & PPP2 and ERC, however, special calculations are required as you cannot double-dip into the same payroll calculations. We know how to optimize your ERC amount and are known for getting clients 20-40% more ERC.

Most payroll companies and CPA’s do not take responsibility for their miscalculations or omissions. The liability is on the Business owner, or client (We have Professional liability insurance, which is documented in your agreement).

No Insurance to protect you from their mistakesNo Qualification processes

The Employee Retention Credit is a Government Incentive. Payroll companies and CPA’s do not specialize in government incentives or ERC Tax Codes. For this reason, some of our clients were told they were not eligible for ERC by their CPA or Payroll companies.

No Access to government orders

Wrong Calculations which then translates to a lower ERC refund for companies.

There are over 75,000 pages of U.S. tax code including federal tax regulations and official tax guidance. ERC and a few other Tax Credits is all we do. It’s analogous to a specialized physician versus a general family practitioner. We specialize in the ERC Tax Code.

We take pride in knowing how to validate your eligibility and accurately calculate your ERC.

It’s as important to us as it is to you to remain compliant.

We get you the money properly so you can keep it too.

The IRS expects 70-80% of Small & Medium size Businesses and tens of thousands of charities to receive the ERC. Many businesses qualify if they were negatively impacted by covid restrictions, vendor disruptions, supply chain issues, travel, and group meetings disruptions. Some experienced reduction in hours or goods and services offered. Many businesses were faced with price increases, all of these scenarios can qualify a business. Speak to one of our ERC Specialists today to find out how!

With billions of dollars in refunds for qualified businesses—Many companies were previously told they did not qualify. It doesn’t cost you anything to see how much your company may get. It’s Your Money, Waiting for You.

NO, It’s Like A Grant.

You do not have to repay the Employee Retention Tax Credit. This is not a loan. ERC is a reward to business owners for retaining their employees during their qualifying periods.

The ERC credit is not considered income for federal income tax purposes, but a reduction of payroll, so you must reduce any deductible wage expenses by the amount of the credit.

After receiving your ERC checks, does the IRS then only require businesses to amend their business tax returns for those respective years (2020 & 2021). The ERC credit is not considered income for federal income tax purposes, but a reduction of payroll, so you must reduce any deductible wage expenses by the amount of the credit. We provide our clients these details after filing if they choose to do it themselves, their CPA or they can choose to have us do it for them.

ERC is a first come first serve basis. Remember how so many businesses didn’t receive PPP because the funds ran out. Therefore, all eligible employers will receive the funds when applied.

We are fast and efficient! Your ERC application (941x) is filed in less than 7 days.

The IRS is taking 3 to 4 months to process ERC files. They directly mail you the approval letter and the checks.

Maybe. Wages of owners who have majority ownership, defined as over 50%, do not qualify, nor do the W2 wages of any immediate family members of that owner who owns over 50%. In the case an owner has less than 50% ownership, their W2 wages qualify, as do the W2 wages paid to immediate family members. In some cases, two partners who are unrelated each own 50%, then both of their W2 wages qualify.

No, if you are majority owner (over 50%) of your company then your wages do not qualify.1099 Employees do not qualify for ERC, unlike PPP.

For Business Owners

Your ERC is Guaranteed

Our Work is Backed By:

Professional Liability Errors & Omissions Insurance

Takes only 60 seconds, 100% risk-free